NIFTY FUTURE OUTLOOK

Nifty future market balance point is at 5841 for today's trading.

Support for nifty future is at 5810-5805.

Break below 5790 will induce correction and nifty will move down to 5755, 5725.

5870-5880 will be the resistance level for nifty future today.

Trading above 5891 nifty future will move to 5910, 5930 and 5950.

NEXT: NIFTY WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Tuesday, November 30, 2010

Sunday, November 28, 2010

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Readers who traded as per last week's outlook would have made close to 30,000 rupees

in just two lots trade of nifty. Those who missed the article can access it here.

The market crashed in a wave of scams and poor results.

Let us see what is in store for traders this week.

The market balance point for nifty future is placed at 5825.

Nifty will get resisted at 5895 and 5940.

For nifty to reverse the current trend, nifty future needs to trade above 5980.

Doing so nifty will zoom past last week's high an move to 6050 and 6125.

On the downside, nifty future will get support at 5750 and 5710.

Break and trade below 5670 will mean trouble and nifty could correct to 5595 and 5525.

The week ahead promises to be one packed with action. Join us on weekdays where

we will track every little move of nifty.

Trade Rich !!!!

NEXT: Yet another short trade in the name of scam

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers who traded as per last week's outlook would have made close to 30,000 rupees

in just two lots trade of nifty. Those who missed the article can access it here.

The market crashed in a wave of scams and poor results.

Let us see what is in store for traders this week.

|

| Nifty Spot |

The market balance point for nifty future is placed at 5825.

Nifty will get resisted at 5895 and 5940.

For nifty to reverse the current trend, nifty future needs to trade above 5980.

Doing so nifty will zoom past last week's high an move to 6050 and 6125.

On the downside, nifty future will get support at 5750 and 5710.

Break and trade below 5670 will mean trouble and nifty could correct to 5595 and 5525.

The week ahead promises to be one packed with action. Join us on weekdays where

we will track every little move of nifty.

Trade Rich !!!!

NEXT: Yet another short trade in the name of scam

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Thursday, November 25, 2010

Bribery Scam hits the Market - How will nifty react

Banking, Reality and Finance stocks hammered as bribery scam hits the market

Bribery scam rocked Indian stock market in latter part of trading yesterday.

Nifty tanked to 5835 as traders queued up to sell LIC, Central Bank, Punjab National Bank ,Bank of India , DB Reality & Money matters.

Finance ministry is quick to update that it is not a scam, but a bribery case.

Readers can get the full coverage of this story on business line

Let us see how to trade nifty today.

5877 is the market balance point for today.

Resistance for nifty is at 5915 and 5935.

Break out level is 5955.

Trading above 5955 , nifty will move to 5995, 6030 and 6065.

Support for nifty futures is 5840 and 5820.

Break and trade below 5800 is disaster for nifty and it will move

down to 5760, 5725 and 5690.

NEXT: WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Wednesday, November 24, 2010

Tuesday, November 23, 2010

Nifty Trading Plan 23-November-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar as nifty moved from

5925 to 6025 exactly as written in this column yesterday. Those who missed the article can access it

here.

Market Balance point for nifty future is placed at 6005.

Nifty future will have resistance at 6030 and 6050. Trading above 6065 will take nifty future to

6095, 6125 and 6140.

Nifty future support is placed at 5975, 5959.

Break below 5940 will induce correction and nifty will move down to

5910, 5875, 5855.

NEXT: NIFTY WEEKLY OUTLOOK

Readers of the blog would have minted the almighty dollar as nifty moved from

5925 to 6025 exactly as written in this column yesterday. Those who missed the article can access it

here.

Market Balance point for nifty future is placed at 6005.

Nifty future will have resistance at 6030 and 6050. Trading above 6065 will take nifty future to

6095, 6125 and 6140.

Nifty future support is placed at 5975, 5959.

Break below 5940 will induce correction and nifty will move down to

5910, 5875, 5855.

NEXT: NIFTY WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, November 21, 2010

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Expiry week is here. Readers who went through our weekly article last week

would have had no problem in navigating the twists and turns of the market.

For this week, market balance point is placed at 5925.

Expiry week is here. Readers who went through our weekly article last week

would have had no problem in navigating the twists and turns of the market.

For this week, market balance point is placed at 5925.

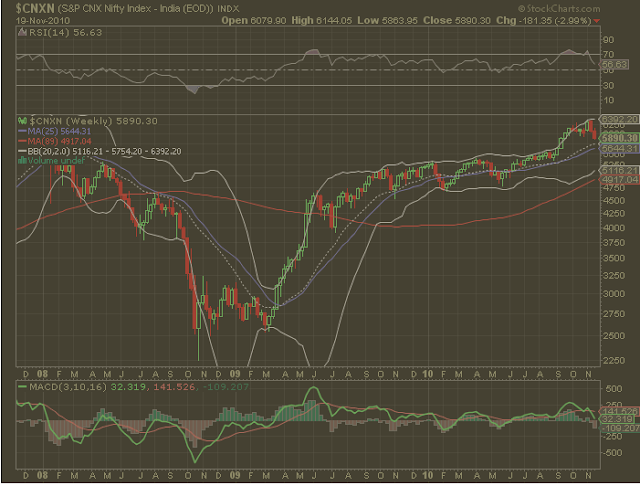

|

| Nifty chart |

Resistance of nifty is placed at 5990 and 6030.

For nifty to trade in positive zone it must cross 6068.

In such a case nifty will move to 6140, 6210, 6250.

Support for nifty future is placed at 5850 & 5810.

Break below 5775, will take nifty to 5700 and 5630.

NEXT: chart predicts doom

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Friday, November 19, 2010

Nifty Trading Plan 19-November-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar in nifty future

in yesterday's trade as nifty reversed from resistance to support and from support

to resistance. Those who were unlucky to miss out yesterday's article can access the

same here.

Readers who entered weekly short in RELINFRA would be richer by Rs 20,000 on a

single lot of trade as the stock crashed to 971.

Those who missed the article can access it here.

For today's trading market balance point is placed at 6020.

5983 is strong support level for nifty future today.

Reversal from 5983 will take nifty to 6055, 6075 and 6105.

Break below 5955 will indicate that yesterday's upmove was a flash in the pan

and nifty will nose dive to 5915. 5900-5895 remains the last line of support for nifty

below which expect nifty to fall to 5845 and 5825 in no time.

Readers of the blog would have minted the almighty dollar in nifty future

in yesterday's trade as nifty reversed from resistance to support and from support

to resistance. Those who were unlucky to miss out yesterday's article can access the

same here.

Readers who entered weekly short in RELINFRA would be richer by Rs 20,000 on a

single lot of trade as the stock crashed to 971.

Those who missed the article can access it here.

For today's trading market balance point is placed at 6020.

5983 is strong support level for nifty future today.

Reversal from 5983 will take nifty to 6055, 6075 and 6105.

Break below 5955 will indicate that yesterday's upmove was a flash in the pan

and nifty will nose dive to 5915. 5900-5895 remains the last line of support for nifty

below which expect nifty to fall to 5845 and 5825 in no time.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

NEXT: Money Tree

Wednesday, November 17, 2010

Nifty Trading Plan 18-November-2010

NIFTY FUTURE OUTLOOK

The market balance point for nifty future is placed at 5985 tomorrow.

If nifty takes support at this level and reverses, it will move to 6020, 6045.

Break out will be above 6066 and targets for the BO are 6105 and 6145.

Trade below 5960 will take nifty to 5945 and 5920.

Last line of support is 5900.

If this support doesn't hold nifty will move down to 5865 and 5825 in no time.

NEXT: Yet another holiday

The market balance point for nifty future is placed at 5985 tomorrow.

If nifty takes support at this level and reverses, it will move to 6020, 6045.

Break out will be above 6066 and targets for the BO are 6105 and 6145.

Trade below 5960 will take nifty to 5945 and 5920.

Last line of support is 5900.

If this support doesn't hold nifty will move down to 5865 and 5825 in no time.

NEXT: Yet another holiday

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Market Holiday today

Indian stock markets have a holiday today.

Access the list of all holidays for 2010 here.

NEXT: Comparison

Monday, November 15, 2010

Facts - Nifty vs International Indices & Sector performance

NIFTY vs other international indices

Sectoral Indices vs Nifty

NEXT: Nifty Outlook

|

| Source: nseindia.com |

Sectoral Indices vs Nifty

|

| Source: nseindia.com |

NEXT: Nifty Outlook

Nifty Trading Plan 16-November-2010

NIFTY FUTURE OUTLOOK

Readers who short sold RELINFRA at 1055 today would have minted the almighty dollar

as the stock crashed to 1020.

Those who missed the article can access it here.

For tomorrow's trading, the market balance point for nifty future is placed at 6120.

Support for nifty is placed at 6085.

Break below 6070 will invite trouble and nifty will 6050 and 6030.

Break below 6010 is serious trouble and nifty will tank to 5960.

Resistance for nifty future is at 6160.

Break and trade above 6178 will take nifty to 6198, 6210 and 6230.

NEXT: Nifty weekly outlook

Readers who short sold RELINFRA at 1055 today would have minted the almighty dollar

as the stock crashed to 1020.

Those who missed the article can access it here.

For tomorrow's trading, the market balance point for nifty future is placed at 6120.

Support for nifty is placed at 6085.

Break below 6070 will invite trouble and nifty will 6050 and 6030.

Break below 6010 is serious trouble and nifty will tank to 5960.

Resistance for nifty future is at 6160.

Break and trade above 6178 will take nifty to 6198, 6210 and 6230.

NEXT: Nifty weekly outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, November 14, 2010

Indian Stock Market Weekly Outlook

Stocks for trading in the coming week

RELINFRA

IF relinfra future breaks 1037 , it can retrace to 1055.

Trading idea is short at retracement and hold for targets of 1025, 1002 and 985.

1068 can be maintained as stop for this trade.

NEXT: Nifty Weekly outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

RELINFRA

IF relinfra future breaks 1037 , it can retrace to 1055.

Trading idea is short at retracement and hold for targets of 1025, 1002 and 985.

1068 can be maintained as stop for this trade.

NEXT: Nifty Weekly outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Nifty future reversed exactly from weekly resistance level as mentioned

in this column last week. Those who missed the article can access it here.

Readers who did the article would have made a minimum of 25,000 rupees in just lots

trading of nifty future.

For the week ahead , Market balance point for nifty future is placed at 6131.

Support for nifty future is at 6088 level.

Break below 6074 will mean more correction in the offing and nifty will move to

6045 and 5980.

Break below 5980 can mean serious trouble and index can fall to 5945 and 5910.

Resistance for nifty future is placed at 6178 and 6210.

Nifty needs to cross and trade above 6245 in order for trend change to occur.

In such a case, nifty future will move to 6320, 6380 and 6420.

Join us next week where we will track day by day movement of nifty and generate

trading ideas.

NEXT: Money Tree

Nifty future reversed exactly from weekly resistance level as mentioned

in this column last week. Those who missed the article can access it here.

Readers who did the article would have made a minimum of 25,000 rupees in just lots

trading of nifty future.

For the week ahead , Market balance point for nifty future is placed at 6131.

Support for nifty future is at 6088 level.

Break below 6074 will mean more correction in the offing and nifty will move to

6045 and 5980.

Break below 5980 can mean serious trouble and index can fall to 5945 and 5910.

Resistance for nifty future is placed at 6178 and 6210.

Nifty needs to cross and trade above 6245 in order for trend change to occur.

In such a case, nifty future will move to 6320, 6380 and 6420.

Join us next week where we will track day by day movement of nifty and generate

trading ideas.

NEXT: Money Tree

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Friday, November 12, 2010

Nifty Trading Plan 12-November-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar

as nifty future reversed exactly from the level given and crashed to achieve

both targets given. Those who missed out the article can access it here.

Market Balance point for today's trading is placed at 6215.

6188 and 6172 are strong supports for nifty today.

Break below 6155 will induce trouble, and nifty could move down to 6130, 6105.

On the upper side, 6245-6255 will offer strong resistance.

Break above 6275 will bring back positiveness and nifty will move to

6300 and 6325.

NEXT: POWER GRID FOLLOW ON PUBLIC OFFER

Readers of the blog would have minted the almighty dollar

as nifty future reversed exactly from the level given and crashed to achieve

both targets given. Those who missed out the article can access it here.

Market Balance point for today's trading is placed at 6215.

6188 and 6172 are strong supports for nifty today.

Break below 6155 will induce trouble, and nifty could move down to 6130, 6105.

On the upper side, 6245-6255 will offer strong resistance.

Break above 6275 will bring back positiveness and nifty will move to

6300 and 6325.

NEXT: POWER GRID FOLLOW ON PUBLIC OFFER

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Wednesday, November 10, 2010

Power Grid FPO - A closer look

POWERGRID (532898) FPO - Structural Analysis

To partly meet its capital expenditure plans, Power Grid has come out with a follow-on public offer (FPO) at a price band of Rs 85-90 per share.

The offer, will help raise Rs 7,575 crore based on the upper price band, and includes an offer for sale worth Rs 3,787 crore by the government.

The issue opened on 9th Nov and lasts till 12th Nov.

The price band is set at 85-90 rs. Retail Investors will get a 5% discount on the issue price.

How good is it ? - The fundamentals

Power Grid is a giant company in the field of power transmission in india.

It is so big that it is even the 3rd largest power transmission utility company in the whole world.

Powergrid currently trades at 3 times book value and 17 times PE.

Power grid is expected to report 20 percent growth in revenue in the next 3 years.

This means that the Book Value of the stock could move up to 53 - 56 level in next 3 years.

How good is it ? - The technicals

MACD is below zero line and moving up. RSI is neither overbought nor oversold.

95 is srong support for the stock. Weekly close below this will take the stock down to 80 levels.

On the upper end 110 - 115 is huge resistance. The stock needs a weekly close above 120 for decent run upwards.

Conclusion

The Qualified institution part of the issue is already subscribed 2 times.

So can we expect another coal india ?

Well it depends on the kind of returns one is expecting.

If a retail investor applies for 1000 shares at cutoff price of 90 rs which is the higher end of spectrum,

he will probably get 700 shares allocated.

Considering th 5% discount, the retail investor will be issued stocks at 85.50 rs per share.

So one can safely expect a listing gain of 5 - 15%.

At the higher end of spectrum of price movement, if the stock moves to 110, the investor

can pocket a gain of 28.6%.

However, one must note that this an FPO unlike Coal India (IPO). Stock has been around for some time.

It is very low beta stock and so taking the gains out, might take time.

A very good fundamental stock with very low beta -- not good for traders, good for long term investors is our conclusion.

NEXT: Nifty Outlook

To partly meet its capital expenditure plans, Power Grid has come out with a follow-on public offer (FPO) at a price band of Rs 85-90 per share.

The offer, will help raise Rs 7,575 crore based on the upper price band, and includes an offer for sale worth Rs 3,787 crore by the government.

The issue opened on 9th Nov and lasts till 12th Nov.

The price band is set at 85-90 rs. Retail Investors will get a 5% discount on the issue price.

How good is it ? - The fundamentals

Power Grid is a giant company in the field of power transmission in india.

It is so big that it is even the 3rd largest power transmission utility company in the whole world.

Powergrid currently trades at 3 times book value and 17 times PE.

Power grid is expected to report 20 percent growth in revenue in the next 3 years.

This means that the Book Value of the stock could move up to 53 - 56 level in next 3 years.

How good is it ? - The technicals

MACD is below zero line and moving up. RSI is neither overbought nor oversold.

95 is srong support for the stock. Weekly close below this will take the stock down to 80 levels.

On the upper end 110 - 115 is huge resistance. The stock needs a weekly close above 120 for decent run upwards.

Conclusion

The Qualified institution part of the issue is already subscribed 2 times.

So can we expect another coal india ?

Well it depends on the kind of returns one is expecting.

If a retail investor applies for 1000 shares at cutoff price of 90 rs which is the higher end of spectrum,

he will probably get 700 shares allocated.

Considering th 5% discount, the retail investor will be issued stocks at 85.50 rs per share.

So one can safely expect a listing gain of 5 - 15%.

At the higher end of spectrum of price movement, if the stock moves to 110, the investor

can pocket a gain of 28.6%.

However, one must note that this an FPO unlike Coal India (IPO). Stock has been around for some time.

It is very low beta stock and so taking the gains out, might take time.

A very good fundamental stock with very low beta -- not good for traders, good for long term investors is our conclusion.

NEXT: Nifty Outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 11-November-2010

NIFTY FUTURE OUTLOOK

A bleak day for trading in which nifty moved in a narrow range.

Our readers would have been safe as nifty stayed within levels given in yesterday's column.

For tomorrow's trading, Market Balance Point is placed at 6305.

Support is placed at 6290. Break and trade below 6283 will take nifty down to 6265.

Break below 6260 will make all hell break loose and nifty will correct to 6225 and 6205.

Resistance is at 6320. Nifty needs to cross and trade above 6335 for a breakout.

In such a case nifty will move to 6355 and 6380.

NEXT: A narrow move

A bleak day for trading in which nifty moved in a narrow range.

Our readers would have been safe as nifty stayed within levels given in yesterday's column.

For tomorrow's trading, Market Balance Point is placed at 6305.

Support is placed at 6290. Break and trade below 6283 will take nifty down to 6265.

Break below 6260 will make all hell break loose and nifty will correct to 6225 and 6205.

Resistance is at 6320. Nifty needs to cross and trade above 6335 for a breakout.

In such a case nifty will move to 6355 and 6380.

NEXT: A narrow move

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 10-November-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar as nifty moved down from

resistance to pivot and then again moved from pivot to second long target with clean bar reversals.

It was goldmine article. Those who missed it can access it here. The market balance point for

today's trading is at 6310 today. Support is placed in the zone of 6285 - 6275.

Break and trade below 6262 will weaken nifty and it will correct to 6245, 6225 and 6205.

On the other hand, resistance is placed at 6330- 6340 zone.

Break and trade above 6355 will take nifty to 6372, 6392 and 6410.

Readers of the blog would have minted the almighty dollar as nifty moved down from

resistance to pivot and then again moved from pivot to second long target with clean bar reversals.

It was goldmine article. Those who missed it can access it here. The market balance point for

today's trading is at 6310 today. Support is placed in the zone of 6285 - 6275.

Break and trade below 6262 will weaken nifty and it will correct to 6245, 6225 and 6205.

On the other hand, resistance is placed at 6330- 6340 zone.

Break and trade above 6355 will take nifty to 6372, 6392 and 6410.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

NEXT: Money Tree

Tuesday, November 9, 2010

Nifty Trading Plan 09-November-2010

NIFTY FUTURE OUTLOOK

After an explosive diwali move, nifty future decided to take a pause yesterday.

With all time high just in the reckoning, it remains to be seen why the market decided to take

rest at this level. Does it show the maturity of market participants or does it imply weakness?

Let us examine with levels.

The market balance point for today is 6295.

Resistance is placed at 6305.

Break and trade above 6315 will take nifty to 6330, 6345, 6355.

Support for nifty future us at 6265.

Break and trade belwo 6250 will take nifty to 6235, 6225 and 6210.

NEXT: NIFTY weekly outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

After an explosive diwali move, nifty future decided to take a pause yesterday.

With all time high just in the reckoning, it remains to be seen why the market decided to take

rest at this level. Does it show the maturity of market participants or does it imply weakness?

Let us examine with levels.

The market balance point for today is 6295.

Resistance is placed at 6305.

Break and trade above 6315 will take nifty to 6330, 6345, 6355.

Support for nifty future us at 6265.

Break and trade belwo 6250 will take nifty to 6235, 6225 and 6210.

NEXT: NIFTY weekly outlook

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, November 7, 2010

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Last week nifty traded as per our expectations.

Readers can access that article here. The article predicts and explosive move in nifty, which

is just what happened last week.

For the coming week, nifty is placed at a very interesting juncture.

The market balance point for nifty future is placed at 6265 next week.

Supports come in at 6225 and 6180.

Trading below 6175 will introduce correction in nifty and it will correct to 6125 and 6100.

Break of 6095 will put the whole upmove at risk and nifty will move down to

6050 and 6005.

Resistances for the next week are placed at 6346 and 6380.

6405 is the BO level above which, nifty will move to 6451 and 6490.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Last week nifty traded as per our expectations.

Readers can access that article here. The article predicts and explosive move in nifty, which

is just what happened last week.

For the coming week, nifty is placed at a very interesting juncture.

The market balance point for nifty future is placed at 6265 next week.

Supports come in at 6225 and 6180.

Trading below 6175 will introduce correction in nifty and it will correct to 6125 and 6100.

Break of 6095 will put the whole upmove at risk and nifty will move down to

6050 and 6005.

Resistances for the next week are placed at 6346 and 6380.

6405 is the BO level above which, nifty will move to 6451 and 6490.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Friday, November 5, 2010

Muhurat Trading

Dhan Theras

Markets are closed for regular trading today.

However on the auspicious occasion Dhan Theras there will be a special session of trading

at the exchanges.

Details follow:

NEXT: DIWALI FIREWORKS

Markets are closed for regular trading today.

However on the auspicious occasion Dhan Theras there will be a special session of trading

at the exchanges.

Details follow:

| Lakshmi Puja and Muhurat Trading on Friday, November 05, 2010 | |||||||||||||||||||||

| Lakshmi Puja : 4:00 PM Onwards | |||||||||||||||||||||

| Muhurat Trading Session Details: | |||||||||||||||||||||

The transactions done during the Muhurat Trading session will be settled as a separate settlement (Settlement No.156/10-11 on November 09, 2010). | |||||||||||||||||||||

NEXT: DIWALI FIREWORKS

Thursday, November 4, 2010

Diwali fireworks : HDFC and TATA MOTORS

HDFC AND TATA MOTORS

Readers of the blog would have minted the almighty dollar

in HDFC and TATAMOTORS.

HDFC almost reached third target of long trade.

TATAMOTORS, although triggered short trade stop loss, rocked from there on

to achieve 2nd target of long trade.

Nifty future moved exactly as per our expectations and as written in weekly

article and hit 5290.

For readers of Jerry Technicals , coal india does not matter.

We know how to make regular profits here :-)

Some Links:

HDFC trading idea

TATAMOTORS trading idea

NIFTY WEEKLY LEVELS

Readers of the blog would have minted the almighty dollar

in HDFC and TATAMOTORS.

HDFC almost reached third target of long trade.

TATAMOTORS, although triggered short trade stop loss, rocked from there on

to achieve 2nd target of long trade.

Nifty future moved exactly as per our expectations and as written in weekly

article and hit 5290.

For readers of Jerry Technicals , coal india does not matter.

We know how to make regular profits here :-)

Some Links:

HDFC trading idea

TATAMOTORS trading idea

NIFTY WEEKLY LEVELS

Wednesday, November 3, 2010

Nifty Trading Plan 03-November-2010

NIFTY FUTURE OUTLOOK

The market balance point for today's trading in nifty future is

6145.

6165 is the resistance level. Trading above 6175 will take nifty future to

6190 and 6215.

Above 6215, the targets 6235 and 6255.

On the downside, support for nifty is at 6130 level.

Break and trade below 6115 will invite trouble and nifty will correct to

6100 and 6085.

NEXT: HDFC trading levels

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

The market balance point for today's trading in nifty future is

6145.

6165 is the resistance level. Trading above 6175 will take nifty future to

6190 and 6215.

Above 6215, the targets 6235 and 6255.

On the downside, support for nifty is at 6130 level.

Break and trade below 6115 will invite trouble and nifty will correct to

6100 and 6085.

NEXT: HDFC trading levels

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Monday, November 1, 2010

Stocks for trading 02-November-2010

INTERESTING STOCKS TO TRADE - HDFC

HDFC looks good for trading tomorrow.

For HDFC future,

Long Level: 705.

SL: Low of first 15 minutes (or below 700) whichever is lower).

If HDFC sustains above 705, it will easily move to the targets of

720, 735 and 750.

NEXT: NIFTY FUTURE OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

HDFC looks good for trading tomorrow.

For HDFC future,

Long Level: 705.

SL: Low of first 15 minutes (or below 700) whichever is lower).

If HDFC sustains above 705, it will easily move to the targets of

720, 735 and 750.

NEXT: NIFTY FUTURE OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Subscribe to:

Comments (Atom)