Gold

Bullish Argument

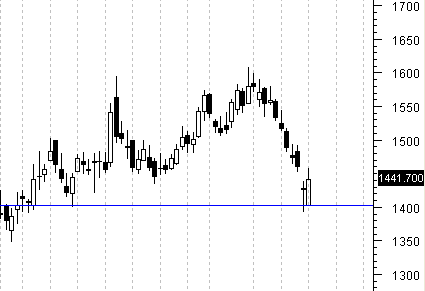

Last week we had written that Gold is likely to test 16200 . Last week Gold future closed exactly at 16200.

The short term indicators are in oversold mode indicating a pull back in gold prices.

If Gold future is able to trade above 16450 with volumes, Gold can spring in a surprise by rallying to 16750.

Bearish Argument

Strong support exists for Gold at 16000. If 16000 is not held, Gold will drift down to 15880 and 15700.

Link to weekly analysis of Indian Stock market

http://jerrytechnicals.blogspot.com/2010/01/weekly-outlook-for-indian-stock-market_30.html

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss.