NIFTY FUTURE WEEKLY OUTLOOK

Nifty future traded as per our expectations last week.

Last week' article can be accessed here.

For the week ahead Market Balance Point for nifty future is placed at 6025.

Nifty will get resisted at 6075 and 6105.

These are Fibonacci confluence resistance and expected to provide strong resistance.

6140 is the weekly break out level . Above this level nifty is expected to out perform

and move to 6190, 6220, 6240 and 6290.

On the downside, strong support for nifty exists at 5975.

5940 is a long term pivot support.

Nifty will play into the hands of bears if it breaks 5915.

In such a case nifty will crack to 5865 and 5820.

It promises to be an action packed week with explosive moves on both side.

We will be tracking day by day movement here at JerryTechnicals.

Everyone is invited !!!.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

NEXT: Bears the Menace

Sunday, October 31, 2010

Friday, October 29, 2010

Nifty Trading Plan 29-October-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar in yesterday's trade in nifty future

as it moved from support to resistance level and reversed from resistance level and hit BD level

as mentioned in yesterday's column.

A wild ride of profits for the aspiring reader.

6051 is the Market balance level for nifty future.

Reversal from 6051 will take nifty future to 6030, 6010 and 5990.

Below 5990, nifty will crash like nine pins to 5925 which is the swing target.

However trading above Market balance level of 6051 will take nifty future

to 6080, 6105, 6125 and 6145.

6145 - 6150 zone will act as strong resistance for nifty future in the coming days.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

NEXT: A perfect expiry

Readers of the blog would have minted the almighty dollar in yesterday's trade in nifty future

as it moved from support to resistance level and reversed from resistance level and hit BD level

as mentioned in yesterday's column.

A wild ride of profits for the aspiring reader.

6051 is the Market balance level for nifty future.

Reversal from 6051 will take nifty future to 6030, 6010 and 5990.

Below 5990, nifty will crash like nine pins to 5925 which is the swing target.

However trading above Market balance level of 6051 will take nifty future

to 6080, 6105, 6125 and 6145.

6145 - 6150 zone will act as strong resistance for nifty future in the coming days.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

NEXT: A perfect expiry

Wednesday, October 27, 2010

Nifty Trading Plan 28-October-2010

NIFTY FUTURE OUTLOOK

Readers who shorted nifty future as per yesterday's article would have minted the almighty dollar

as nifty tanked by 100 points from short level.

For tomorrow's trading the Market Balance Point is at 6038.

Resistance for nifty future is at 6075. Break out will be above 6091.

Trading above 6091, nifty future will move to 6115, 6135 and 6150.

Support for nifty future is at 6000.

Break below 5985 will indicate real trouble and nifty future will move down to

5960, 5945 and 5925.

NEXT: Short means -> money in short time

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers who shorted nifty future as per yesterday's article would have minted the almighty dollar

as nifty tanked by 100 points from short level.

For tomorrow's trading the Market Balance Point is at 6038.

Resistance for nifty future is at 6075. Break out will be above 6091.

Trading above 6091, nifty future will move to 6115, 6135 and 6150.

Support for nifty future is at 6000.

Break below 5985 will indicate real trouble and nifty future will move down to

5960, 5945 and 5925.

NEXT: Short means -> money in short time

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 27-October-2010

NIFTY FUTURE OUTLOOK

For today's trading Market Balance Point is placed at 6110.

Resistances for nifty future are placed at 6130, 6148.

If nifty breaks and trades above 6165 , it should be considered a breakout and nifty will

rock to 6195 , 6225 and 6240.

Supports for nifty future are placed at 6090, 6072.

Break and trade below 6055 indicates trouble for bulls and nifty will correct to

6025, 6000 and 5988.

NEXT: Thrill of money

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

For today's trading Market Balance Point is placed at 6110.

Resistances for nifty future are placed at 6130, 6148.

If nifty breaks and trades above 6165 , it should be considered a breakout and nifty will

rock to 6195 , 6225 and 6240.

Supports for nifty future are placed at 6090, 6072.

Break and trade below 6055 indicates trouble for bulls and nifty will correct to

6025, 6000 and 5988.

NEXT: Thrill of money

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Monday, October 25, 2010

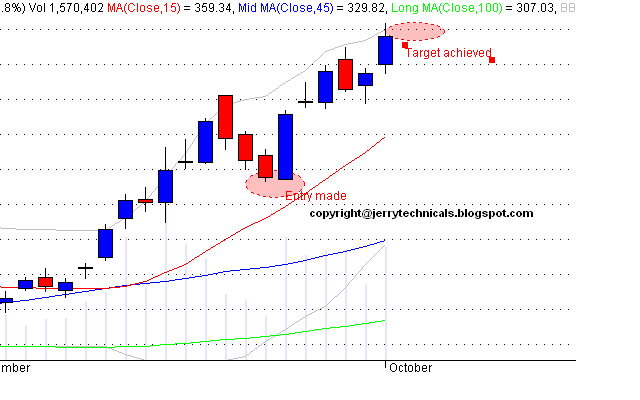

ACC and HDFC BANK Follow up

The tale of a long and short trade

I had recommended two stocks in my weekly outlook.

One was for long trade and other was for short trade.

ACC long rocked as the stock went through the roof after coming to entry point.

HDFC bank reached the short trade entry point and crashed like nine points

to the target given.

A whooping profit of Rs. 20,000 with a single lot trade in each future.

As usual readers who followed us printed the almighty dollar !!!!

Read: ACC & HDFC

NEXT: NIFTY FUTURE OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 26-October-2010

NIFTY FUTURE TRADING

Nifty future Market Balance Level (MBL) for tomorrow's trading is placed at

6136. 6177 - 6197 is the resistance zone for nifty future.

Trading above 6206 will take nifty future to 6223, 6240 and 6260.

6100 is support level for nifty future.

Break and trade below 6085 will introduce negativeness in nifty

and bears will pummel it to 6058 and 6040.

NEXT: Rocking trade reccos

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty future Market Balance Level (MBL) for tomorrow's trading is placed at

6136. 6177 - 6197 is the resistance zone for nifty future.

Trading above 6206 will take nifty future to 6223, 6240 and 6260.

6100 is support level for nifty future.

Break and trade below 6085 will introduce negativeness in nifty

and bears will pummel it to 6058 and 6040.

NEXT: Rocking trade reccos

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, October 24, 2010

Indian Stock Market Weekly Outlook

Stocks to watch for this week

ACC (CLOSE : 989)

Long Entry Point : 975

Stop Loss: 959.80

Targets : 1008, 1040, 1060

Short Entry Point: 959

Stop Loss: 975

Targets: 925, 898

HDFC BANK(CLOSE:2333)

Short Entry Point : 2370

Short Stoploss: 2400

Targets: 2310, 2250

Long Entry Point: 2400

Long Stop Loss : 2370

Targets: 2465, 2500.

NEXT: NIFTY FUTURE WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

ACC (CLOSE : 989)

Long Entry Point : 975

Stop Loss: 959.80

Targets : 1008, 1040, 1060

Short Entry Point: 959

Stop Loss: 975

Targets: 925, 898

HDFC BANK(CLOSE:2333)

Short Entry Point : 2370

Short Stoploss: 2400

Targets: 2310, 2250

Long Entry Point: 2400

Long Stop Loss : 2370

Targets: 2465, 2500.

NEXT: NIFTY FUTURE WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Nifty future traded as per our expectations last week.

For the week ahead Market Resting Point is at 6085.

Resistance for nifty is at 6125 - 6150 zone.

For nifty to trade in positive territory it must break and trade above 6175.

In such a case nifty future will move to 6215, 6245 and 6280.

Support zone for nifty future is 6030 - 6010.

Break and trade below 5985 will indicate trouble for bulls and nifty future will drop to

5940, 5905 and 5860.

NEXT: Zen and the art of Trading

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty future traded as per our expectations last week.

For the week ahead Market Resting Point is at 6085.

Resistance for nifty is at 6125 - 6150 zone.

For nifty to trade in positive territory it must break and trade above 6175.

In such a case nifty future will move to 6215, 6245 and 6280.

Support zone for nifty future is 6030 - 6010.

Break and trade below 5985 will indicate trouble for bulls and nifty future will drop to

5940, 5905 and 5860.

NEXT: Zen and the art of Trading

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Saturday, October 23, 2010

Zen and art of trading

"By knowing the exact vibration of each individual stock I am able to determine at what point each will receive support and what point the greatest resistance is to be met" - W.D Gann

Last week, Kumar, a reader of the blog had written in to ask about Jubilant Organosys.

I posted my response to the reader here.

Yesterday I got another email from Kumar. Contents posted below...

"Hi Jerry,

Thank you for your advice on Jubilant Life Sciences.

As per your blog, I exited the stock at 337.

I was holding this stock from 212, so booked nice profit.

Your analysis was perfect. TJubilant went to 340 and cracked

to below 300 already. I wonder how you are keeping this website

free.

Keep up the good work.

Regards

Kumar V"

The essence of this website is emails like the ones above.

NEXT: Levels is all we need

Last week, Kumar, a reader of the blog had written in to ask about Jubilant Organosys.

I posted my response to the reader here.

Yesterday I got another email from Kumar. Contents posted below...

"Hi Jerry,

Thank you for your advice on Jubilant Life Sciences.

As per your blog, I exited the stock at 337.

I was holding this stock from 212, so booked nice profit.

Your analysis was perfect. TJubilant went to 340 and cracked

to below 300 already. I wonder how you are keeping this website

free.

Keep up the good work.

Regards

Kumar V"

The essence of this website is emails like the ones above.

NEXT: Levels is all we need

Friday, October 22, 2010

Nifty Trading Plan 22-October-2010

NIFTY FUTURE OUTLOOK

What a rocking day !!! Once 6070 was crossed, there was no looking back

for bulls and they lifted nifty to 6152.

For today's trading, nifty pivot is placed at 6105.

Support is placed at 6069. For nifty to turn negative it must break and trade below

6053. Doing that nifty will fall in a straight line to 6023 , 5988 and 5955.

On the other hand, resistance for nifty is at 6150. Above 6170 nifty will move to

6190, and 6225.

Next: Bulls regain control

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

What a rocking day !!! Once 6070 was crossed, there was no looking back

for bulls and they lifted nifty to 6152.

For today's trading, nifty pivot is placed at 6105.

Support is placed at 6069. For nifty to turn negative it must break and trade below

6053. Doing that nifty will fall in a straight line to 6023 , 5988 and 5955.

On the other hand, resistance for nifty is at 6150. Above 6170 nifty will move to

6190, and 6225.

Next: Bulls regain control

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Wednesday, October 20, 2010

Nifty Trading Plan 21-October-2010

NIFTY FUTURE OUTLOOK

Readers who went short in nifty future today at resistance level mentioned in yesterday's

column would have minted the almighty dollar as nifty crashed from resistance to target level.

For tomorrow's trading nifty pivot level is at 6045.

Resistance is placed at 6058. If nifty trades above 6070 it will move to 6090, 6115 and 6135.

Support level is at 5983.

If nifty breaks and trades below 5968 it will slide to 5950 and 5925.

NEXT: Bears on the prowl !!!

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers who went short in nifty future today at resistance level mentioned in yesterday's

column would have minted the almighty dollar as nifty crashed from resistance to target level.

For tomorrow's trading nifty pivot level is at 6045.

Resistance is placed at 6058. If nifty trades above 6070 it will move to 6090, 6115 and 6135.

Support level is at 5983.

If nifty breaks and trades below 5968 it will slide to 5950 and 5925.

NEXT: Bears on the prowl !!!

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 20-October-2010

NIFTY FUTURE OUTLOOK

Readers who shorted nifty future yesterday at resistance level would have minted

the almighty dollar as nifty crashed 130 + points from short level.

Those who missed the article can access it here.

For today's trading, nifty pivot is placed at 6050.

Support is placed at 6011. Below 6000 level nifty will straight away move down to 5980 which is

really strong support level for nifty. Trading below 5980 is dangerous for bulls as market will

easily correct to 5942 and finally 5925, the swing target as mentioned in weekly outlook.

6085-6100 range is huge resistance for nifty future today.

For nifty to trade in positive zone it must cross and trade above 6128.

If nifty is able to do so, it will move to 6160 and 6190.

NEXT: Swing trade pick

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers who shorted nifty future yesterday at resistance level would have minted

the almighty dollar as nifty crashed 130 + points from short level.

Those who missed the article can access it here.

For today's trading, nifty pivot is placed at 6050.

Support is placed at 6011. Below 6000 level nifty will straight away move down to 5980 which is

really strong support level for nifty. Trading below 5980 is dangerous for bulls as market will

easily correct to 5942 and finally 5925, the swing target as mentioned in weekly outlook.

6085-6100 range is huge resistance for nifty future today.

For nifty to trade in positive zone it must cross and trade above 6128.

If nifty is able to do so, it will move to 6160 and 6190.

NEXT: Swing trade pick

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Tuesday, October 19, 2010

Swing Trade Pick : BAJAJ FIN SERV

BAJAJFINSERV (532978)

BajajFinServ is near crucial support.

The stock is looking good for a swing long.

476 on closing basis should be Stop for this trade.

Stock can rocket to 530, 560 and 590.

NEXT: NIFTY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

BajajFinServ is near crucial support.

The stock is looking good for a swing long.

476 on closing basis should be Stop for this trade.

Stock can rocket to 530, 560 and 590.

NEXT: NIFTY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 19-October-2010

NIFTY FUTURE OUTLOOK

Nifty future pivot for today's trading is placed at 6111.

Strong support exists at 6073. For nifty to lose its momentum it must trade below 6058.

Break and trade below 6058 will take nifty future to 6020.

Resistance for nifty future is at 6150 - 6170 area.

Break and trade above 6170 will take nifty future into the 6200s and will move to

6225, 6240 and 6265.

NEXT: NIFTY WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty future pivot for today's trading is placed at 6111.

Strong support exists at 6073. For nifty to lose its momentum it must trade below 6058.

Break and trade below 6058 will take nifty future to 6020.

Resistance for nifty future is at 6150 - 6170 area.

Break and trade above 6170 will take nifty future into the 6200s and will move to

6225, 6240 and 6265.

NEXT: NIFTY WEEKLY OUTLOOK

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, October 17, 2010

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Last week I had presented the fibonacci time analysis and argued with evidence that nifty volatility

will increase in the coming period. What an epic week had !!! Index moved both sides in a very violent

manner. Readers of this blog would have been safe as the same had been forewarned here.

What can we expect in the coming week?

For the coming week, nifty future pivot is placed at 6130 level.

Nifty future will face huge resistance at 6165 level.

For nifty to move into positive territory it must trade above 6200.

Doing so nifty future will move to 6225, 6250 and 6295.

If nifty breaks and trades below 6070, bears will have no trouble in taking the index

down to 6020, 5985 and 5955.

The swing target for nifty is at 5925.

NEXT: Answering questions from readers

Continuing coverage of IDFC INFRASTRUCTURE BONDS : closing on 22nd October

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Last week I had presented the fibonacci time analysis and argued with evidence that nifty volatility

will increase in the coming period. What an epic week had !!! Index moved both sides in a very violent

manner. Readers of this blog would have been safe as the same had been forewarned here.

What can we expect in the coming week?

For the coming week, nifty future pivot is placed at 6130 level.

Nifty future will face huge resistance at 6165 level.

For nifty to move into positive territory it must trade above 6200.

Doing so nifty future will move to 6225, 6250 and 6295.

If nifty breaks and trades below 6070, bears will have no trouble in taking the index

down to 6020, 5985 and 5955.

The swing target for nifty is at 5925.

NEXT: Answering questions from readers

Continuing coverage of IDFC INFRASTRUCTURE BONDS : closing on 22nd October

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers Query - JUBILANT ORGANOSYS LTD (530019)

Jubilant Life Sciences Ltd

A reader has emailed in to seek my opinion on Jubilant Life Sciences.

The following chart shows the Jubilant is very weak and stock could correct strongly. A bounce to 330 - 340 level should be used to exit holdings from this stock. In the near term, stock could correct to 250

level.

NEXT: IDFC INFRASTRUCTURE BOND

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

A reader has emailed in to seek my opinion on Jubilant Life Sciences.

The following chart shows the Jubilant is very weak and stock could correct strongly. A bounce to 330 - 340 level should be used to exit holdings from this stock. In the near term, stock could correct to 250

level.

|

| JUBIILANT ORGANOSYS - Looking bad on charts |

NEXT: IDFC INFRASTRUCTURE BOND

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Thursday, October 14, 2010

Nifty Trading Plan 15-October-2010

NIFTY FUTURE OUTLOOK

6200 is the pivot level for tomorrow's trading in nifty future.

6165 is the key support level for nifty.

Break and trade below 6130 would mean nifty correcting to 6095 and 6060.

6235 will be huge resistance level for nifty future.

For nifty to trade in positive zone it must break and trade above 6268.

In such a scenario nifty will move to 6305 and 6330.

NEXT: Bears rule the roost

Special: IDC INFRASTRUCTURE BOND

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

6200 is the pivot level for tomorrow's trading in nifty future.

6165 is the key support level for nifty.

Break and trade below 6130 would mean nifty correcting to 6095 and 6060.

6235 will be huge resistance level for nifty future.

For nifty to trade in positive zone it must break and trade above 6268.

In such a scenario nifty will move to 6305 and 6330.

NEXT: Bears rule the roost

Special: IDC INFRASTRUCTURE BOND

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty Trading Plan 14-October-2010

NIFTY FUTURE OUTLOOK

What a move by bulls.

On huge FII buying yesterday nifty and sensex went through the roof.

Nifty exactly moved up from pivot level mentioned in yesterday's article.

For today's trading nifty future pivot has moved to 6249.

Resistance is at 6288 and above 6304 nifty will rocket to 6340 and 6380.

Reversal from resistance will take nifty to 6249 and 6210.

For nifty to be in negative zone, it must break and trade below 6194.

Doing so nifty will correct to 6140 and 6120.

NEXT: NIFTY FUTURE SOARS FROM PIVOT

SPECIAL: Coverage of IDFC infrastructure bonds

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

What a move by bulls.

On huge FII buying yesterday nifty and sensex went through the roof.

Nifty exactly moved up from pivot level mentioned in yesterday's article.

For today's trading nifty future pivot has moved to 6249.

Resistance is at 6288 and above 6304 nifty will rocket to 6340 and 6380.

Reversal from resistance will take nifty to 6249 and 6210.

For nifty to be in negative zone, it must break and trade below 6194.

Doing so nifty will correct to 6140 and 6120.

NEXT: NIFTY FUTURE SOARS FROM PIVOT

SPECIAL: Coverage of IDFC infrastructure bonds

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Wednesday, October 13, 2010

Nifty Trading Plan 13-October-2010

NIFTY FUTURE TRADING PLAN

Nifty pivot is placed at 6117 for today's trading.

Above 6117 nifty will move to 6135 and 6155, which are strong resistances for the day.

Breakout level is 6171. Above this level nifty will move to 6195 and 6210.

Support exists for nifty at 6080.

Break an trade below 6064 will take nifty to 6048, 6030 and 6015.

NEXT: Reversal from pivot

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty pivot is placed at 6117 for today's trading.

Above 6117 nifty will move to 6135 and 6155, which are strong resistances for the day.

Breakout level is 6171. Above this level nifty will move to 6195 and 6210.

Support exists for nifty at 6080.

Break an trade below 6064 will take nifty to 6048, 6030 and 6015.

NEXT: Reversal from pivot

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Monday, October 11, 2010

Nifty Trading Plan 12-October-2010

NIFTY FUTURE OUTLOOK

Nifty future high was the resistance level and low was pivot level as mentioned in yesterday's

article. Those who missed it can access it here.

For tomorrow's trading nifty future pivot is placed at 6160.

Resistance will come in at 6200.

Trading above 6216 will induce bullishness and index will move to 6235, 6250 and 6270.

Support for nifty is in the 6130 - 6120 region.

Break and trade below 6105 will make nifty correct to 6090, 6070 and 6040.

NEXT: Coverage on IDFC Infrastructure bonds

Weekly outlook nifty future

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty future high was the resistance level and low was pivot level as mentioned in yesterday's

article. Those who missed it can access it here.

For tomorrow's trading nifty future pivot is placed at 6160.

Resistance will come in at 6200.

Trading above 6216 will induce bullishness and index will move to 6235, 6250 and 6270.

Support for nifty is in the 6130 - 6120 region.

Break and trade below 6105 will make nifty correct to 6090, 6070 and 6040.

NEXT: Coverage on IDFC Infrastructure bonds

Weekly outlook nifty future

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, October 10, 2010

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Last week, just like what was written in this column, nifty future moved to 6245 and gave up

all the gains and fell to the support of 6100. Readers who missed last week's column can access it

here.

As per Fibonacci time zones, next week could be a very interesting week. See the chart below,

It is very clear from the above chart that whenever nifty enters the time zone, volatility increases.

For the coming week, nifty future pivot is placed at 6138.

Resistance is at 6185. Trading above 6207 will restore bullishness in nifty and it will move to

6245, 6280 and 6300.

Support level for nifty future is placed at 6105. Break and trade below 6090 will invite bears to

have a good week and they will thrash nifty to 6050, 6015 and 5970.

NEXT: Should we buy IDFC INFRASTRUCTURE BONDS?

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Last week, just like what was written in this column, nifty future moved to 6245 and gave up

all the gains and fell to the support of 6100. Readers who missed last week's column can access it

here.

As per Fibonacci time zones, next week could be a very interesting week. See the chart below,

It is very clear from the above chart that whenever nifty enters the time zone, volatility increases.

For the coming week, nifty future pivot is placed at 6138.

Resistance is at 6185. Trading above 6207 will restore bullishness in nifty and it will move to

6245, 6280 and 6300.

Support level for nifty future is placed at 6105. Break and trade below 6090 will invite bears to

have a good week and they will thrash nifty to 6050, 6015 and 5970.

NEXT: Should we buy IDFC INFRASTRUCTURE BONDS?

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Saturday, October 9, 2010

IDFC Infrastructure Bond - Should we be buying it ?

IDFC INFRASTRUCTURE BONDS

Have a look at any paper, one will be bombarded with ads for IDFC infra bonds.

The brokers are hiring temporary helps to cold call customers and getting them to invest.

And I was no exception. I also got enticed. So I decided to do a study on what is the deal about

IDFC infra bonds. Here are my findings.

What is the noise all about?

It all started with the budget in which FM announced extra tax rebate for infra bonds which is in addition to the existing 1L limit. And that is the only advantage of this whole thing.

I will explain why.

IDFC infrastructure bonds come in 4 series. (More on that later).

The interest rate on these bonds are either 7.5 or 8%. Now if I subtract tax from it,

returns become paltry 5.5 to 6%. Not so good now right?

However, if you add the tax benefit returns become 9 - 9.5%. This is much better isn't it.

So we have established, that this infra bond thing is useful only for tax saving.

Ok now to the technical stuff.

Minimum investment a person has to make is 10,000 rs.

One can invest more than 20,000 , but he/she will receive tax break only for 20,000.

How can one invest in IDFC infrastructure bond

One needs to have a demat account for investing in this bond, as these bonds will be listed

on both NSE and BSE.

Lock-in Period - When will I get money back

Lock-in period for these bonds are 5 years and maturity period is 10 years.

What does this mean? You cannot get this money back till the end of 5th year.

After 5 years, you can hold it till 10 years when IDFC will give your original money + interest earned.

Another option is, since these bonds are listed on the stock exchanges, one can sell it off in the

market just like any other stock after 5 years.

What is this 4 series ?

IDFC has introduced bonds in 4 flavours. Series 1, Series 2, Series 3, Series 4.

Essentially they differ in type of interest and buyback.

Series 2 and 4 pay cumulative interest.

Series 3 and 4 offer buyback. Buy back means, you can sell the bonds to IDFC at the end of 5

years. If one doesn't take this option, he will have to sell it in NSE or BSE as explained above.

What is the conclusion

1) Don't bother about this unless are in 30% income tax bracket.

2) Invest only maximum of 20,000.

3) I will only go for series 4 (cumulative + buy back + interest rate of 7.5%) since my objective is

only to get tax break.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Have a look at any paper, one will be bombarded with ads for IDFC infra bonds.

The brokers are hiring temporary helps to cold call customers and getting them to invest.

And I was no exception. I also got enticed. So I decided to do a study on what is the deal about

IDFC infra bonds. Here are my findings.

What is the noise all about?

It all started with the budget in which FM announced extra tax rebate for infra bonds which is in addition to the existing 1L limit. And that is the only advantage of this whole thing.

I will explain why.

IDFC infrastructure bonds come in 4 series. (More on that later).

The interest rate on these bonds are either 7.5 or 8%. Now if I subtract tax from it,

returns become paltry 5.5 to 6%. Not so good now right?

However, if you add the tax benefit returns become 9 - 9.5%. This is much better isn't it.

So we have established, that this infra bond thing is useful only for tax saving.

Ok now to the technical stuff.

Minimum investment a person has to make is 10,000 rs.

One can invest more than 20,000 , but he/she will receive tax break only for 20,000.

How can one invest in IDFC infrastructure bond

One needs to have a demat account for investing in this bond, as these bonds will be listed

on both NSE and BSE.

Lock-in Period - When will I get money back

Lock-in period for these bonds are 5 years and maturity period is 10 years.

What does this mean? You cannot get this money back till the end of 5th year.

After 5 years, you can hold it till 10 years when IDFC will give your original money + interest earned.

Another option is, since these bonds are listed on the stock exchanges, one can sell it off in the

market just like any other stock after 5 years.

What is this 4 series ?

IDFC has introduced bonds in 4 flavours. Series 1, Series 2, Series 3, Series 4.

Essentially they differ in type of interest and buyback.

Series 2 and 4 pay cumulative interest.

Series 3 and 4 offer buyback. Buy back means, you can sell the bonds to IDFC at the end of 5

years. If one doesn't take this option, he will have to sell it in NSE or BSE as explained above.

What is the conclusion

1) Don't bother about this unless are in 30% income tax bracket.

2) Invest only maximum of 20,000.

3) I will only go for series 4 (cumulative + buy back + interest rate of 7.5%) since my objective is

only to get tax break.

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Thursday, October 7, 2010

Nifty Trading Plan 08-October-2010

NIFTY FUTURE OUTLOOK

Nifty future reversed from pivot level mentioned in this column yesterday

and then crashed to short targets.

For tomorrow's trade Nifty future pivot is moved to 6157.

Support level is 6115. Break and trade below 6100 will be disastrous for nifty and

it will move down to 6085, 6060 and 6040.

Resistance level for nifty is at 6195. For nifty to trade in positive zone it must

cross break out level of 6207.

In doing so nifty will move to 6230 and 6255.

NEXT: 'Precisionfull' target

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty future reversed from pivot level mentioned in this column yesterday

and then crashed to short targets.

For tomorrow's trade Nifty future pivot is moved to 6157.

Support level is 6115. Break and trade below 6100 will be disastrous for nifty and

it will move down to 6085, 6060 and 6040.

Resistance level for nifty is at 6195. For nifty to trade in positive zone it must

cross break out level of 6207.

In doing so nifty will move to 6230 and 6255.

NEXT: 'Precisionfull' target

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Wednesday, October 6, 2010

Swing Trade Pick : IndiaBulls Real Estate : Update

UPDATE : IBREALEST (532832)

IBREALEST achieved the swing target as mentioned in our blog.

A clean return for a bit over a week's trade.

Those who missed the article can access it here

Another day when readers of this blog minted the almighty dollar !!!

NEXT: NIFTY OUTLOOK

IBREALEST achieved the swing target as mentioned in our blog.

A clean return for a bit over a week's trade.

Those who missed the article can access it here

Another day when readers of this blog minted the almighty dollar !!!

NEXT: NIFTY OUTLOOK

Nifty Trading Plan 07-October-2010

NIFTY FUTURE OUTLOOK

Nifty moved from pivot to resistance level as mentioned in yesterday's column.

However bulls could not cross the upper level of 5248.

For tomorrow's trading, nifty future pivot is placed at 5210.

Support is placed at 6173 and break out level at 6158.

Trading below 6158 will take nifty future down to 6140, 6125 and 6100.

Resistance level has moved to break out level of yesterday and is at 5248.

Trading above 6265 will take nifty future will take nifty to 5299 and 5315.

NEXT: Power of levels

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Nifty moved from pivot to resistance level as mentioned in yesterday's column.

However bulls could not cross the upper level of 5248.

For tomorrow's trading, nifty future pivot is placed at 5210.

Support is placed at 6173 and break out level at 6158.

Trading below 6158 will take nifty future down to 6140, 6125 and 6100.

Resistance level has moved to break out level of yesterday and is at 5248.

Trading above 6265 will take nifty future will take nifty to 5299 and 5315.

NEXT: Power of levels

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Tuesday, October 5, 2010

Nifty Trading Plan 06-October-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have printed the almighty dollar today in nifty future, as it

reversed exactly from resistance level given yesterday and crashed 60 rupees.

Those who missed the article can access it here.

For tomorrow's trading. nifty future pivot is placed at 6182.

Support for nifty is at 6144. Below 6130 bears will pound nifty 6115, 6100 and 6085.

Resistance level for nifty is at 6225,

For nifty to be attracted by bulls, it needs to cross 5241.

Doing so, nifty might attempt to scale 6255 and 6270.

NEXT: Resistance overhead

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers of the blog would have printed the almighty dollar today in nifty future, as it

reversed exactly from resistance level given yesterday and crashed 60 rupees.

Those who missed the article can access it here.

For tomorrow's trading. nifty future pivot is placed at 6182.

Support for nifty is at 6144. Below 6130 bears will pound nifty 6115, 6100 and 6085.

Resistance level for nifty is at 6225,

For nifty to be attracted by bulls, it needs to cross 5241.

Doing so, nifty might attempt to scale 6255 and 6270.

NEXT: Resistance overhead

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Monday, October 4, 2010

Nifty Trading Plan 05-October-2010

NIFTY FUTURE OUTLOOK

Readers of the blog would have minted the almighty dollar in today's trade as nifty reversed

exactly from first target of long and crashed to resistance level (which in turn became support).

It was a clean short as per ema trading system too. Link

For tomorrow's trading, pivot is placed at 6188.

Support level is 6150. Trade below 6135 will induce strong correction in nifty and it will

move down to 6115, 6095 and 6060.

Resistance level for tomorrow is placed at 6226.

For nifty to regain lost momentum on upside, it must cross and trade above today's high of 6248.

Doing so, bulls will come in hoards and lift nifty to 6270, 6299 and 6315 by close.

All set for a interesting day tomorrow. Let us wait and watch.

NEXT: F&O lot size change

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Readers of the blog would have minted the almighty dollar in today's trade as nifty reversed

exactly from first target of long and crashed to resistance level (which in turn became support).

It was a clean short as per ema trading system too. Link

For tomorrow's trading, pivot is placed at 6188.

Support level is 6150. Trade below 6135 will induce strong correction in nifty and it will

move down to 6115, 6095 and 6060.

Resistance level for tomorrow is placed at 6226.

For nifty to regain lost momentum on upside, it must cross and trade above today's high of 6248.

Doing so, bulls will come in hoards and lift nifty to 6270, 6299 and 6315 by close.

All set for a interesting day tomorrow. Let us wait and watch.

NEXT: F&O lot size change

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Sunday, October 3, 2010

F&O Lot Size in NSE futures and options revision

F&O LOT SIZE REVISION

NSE is revising lotsizes for some contracts.

List of contracts where lot sizes are revised downwards:

List of contracts where lot size is revised upwards:

This is effective 29 October 2010.

Source: www.nseindia.com

NEXT: NIFTY FUTURE WEEKLY OUTLOOK

NSE is revising lotsizes for some contracts.

List of contracts where lot sizes are revised downwards:

List of contracts where lot size is revised upwards:

This is effective 29 October 2010.

Source: www.nseindia.com

NEXT: NIFTY FUTURE WEEKLY OUTLOOK

Indian Stock Market Weekly Outlook

NIFTY FUTURE WEEKLY OUTLOOK

Last week I had written that 5962 will be strong support for nifty future.

Nifty low was exactly 1 point above the support level.

Those who missed last week's article can access it here.

For next week, nifty future pivot is placed at 6140.

6180 is the resistance for NF. 6195 is BO point for nifty next week.

Trading above 6195 nifty future will move to 6245 and 6299.

6300 to 6344 is historical resistance zone.

On the down side, support for nifty this week is at 6100 level.

Break and trade below 6075 will indicate trouble and nifty will correct to

6025, 5965 and 5910.

NEXT: Making money in unitech

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Last week I had written that 5962 will be strong support for nifty future.

Nifty low was exactly 1 point above the support level.

Those who missed last week's article can access it here.

For next week, nifty future pivot is placed at 6140.

6180 is the resistance for NF. 6195 is BO point for nifty next week.

Trading above 6195 nifty future will move to 6245 and 6299.

6300 to 6344 is historical resistance zone.

On the down side, support for nifty this week is at 6100 level.

Break and trade below 6075 will indicate trouble and nifty will correct to

6025, 5965 and 5910.

NEXT: Making money in unitech

Disclaimer : This is not a recommendation/ solicitation of any order to buy or sell, but Jerry's view on indian stock market. I assume no responsibility for any opinion or statement made in this blog. Readers are urged to exercise their own judgment in trading. Readers shall solely be responsible for profit/loss

Saturday, October 2, 2010

Swing Trade Pick : UNITECH : Update

Readers who went long in UNITECH at 81 would be laughing all the way to the bank.

Unitech blasted its way through resistances and closed at 94.4 on firday.

Those who missed the article can access it here.

A trade in unitech cash using 3000 shares itself would have given the reader a profit of

39,000 rupees.

All this entirely free of cost at jerrytechnicals. Is your paid site giving you this much returns?

NEXT: DLF on the move

Unitech blasted its way through resistances and closed at 94.4 on firday.

Those who missed the article can access it here.

A trade in unitech cash using 3000 shares itself would have given the reader a profit of

39,000 rupees.

All this entirely free of cost at jerrytechnicals. Is your paid site giving you this much returns?

NEXT: DLF on the move

Swing Trade Pick : DLF : Update

Readers would have minted the almighty dollar in DLF as it achieved all targets.

Those who missed the article can access it here

It is a raging bull market. But are you making money ?

NEXT: Explosive move on friday

Those who missed the article can access it here

It is a raging bull market. But are you making money ?

NEXT: Explosive move on friday

Subscribe to:

Posts (Atom)